On May 20th, according to the latest "China XR Device Retail Market Tracking Report" released by RUNTO Technology, the omnichannel sales of consumer grade XR devices (including AR and VR/MR) in China reached 147000 units in the first quarter of 2025, a year-on-year increase of 26.7%; The sales revenue was 460 million yuan, a year-on-year increase of 25.5%.

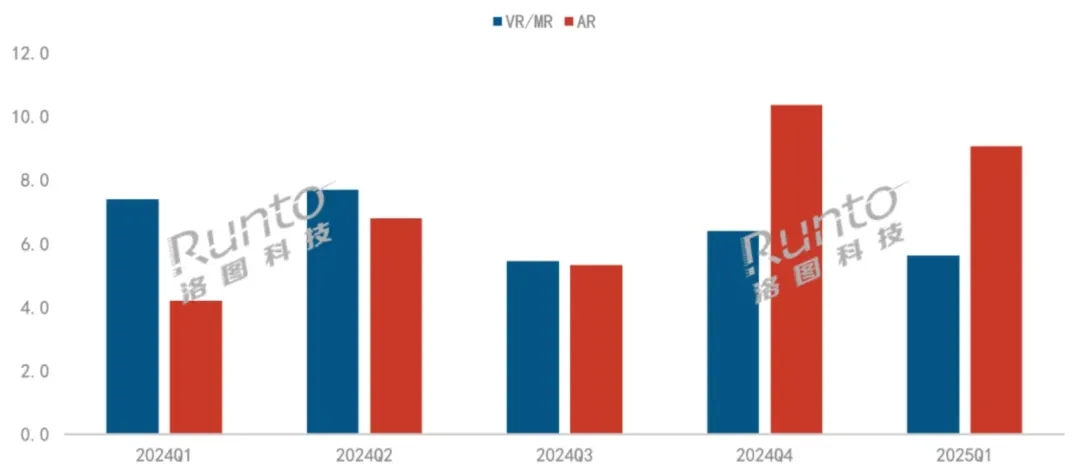

In terms of segmentation, the sales volume of VR/MR devices was 56000 units, a year-on-year decrease of 24%; The sales of AR devices reached 91000 units, a significant increase of 116% year-on-year. Since last year, the market trends of the two have begun to diverge, and by the fourth quarter, their market positions began to reverse.

Quarterly sales trend of China's consumer XR device market from 2024 to Q1 2025, data source: RUNTO omnichannel data, unit: 10000 units

In addition, AI glasses, as the most eye-catching product in the field of head mounted devices and an emerging product extended from the XR industry chain, achieved multi-channel sales (including AI+AR) of 71000 pairs in the first quarter, a year-on-year increase of 193%.

According to data from RUNTO Technology, in the first quarter of 2025, XR devices accounted for 49.7% of the total sales in China's online public retail market (excluding emerging e-commerce platforms such as Pinduoduo), reaching 73000 units, a year-on-year increase of 43.2%; The sales revenue was 230 million yuan, a year-on-year increase of 41.9%.

The sales pattern of AR and VR/MR reversed earlier in the online market, as early as the second quarter of last year. The sales ratio of the two has evolved from 49:51 in the first quarter of 2024 to 71:29 in the first quarter of 2025, and AR devices have firmly dominated the XR consumer retail market.