On September 5th, CINNO Research's Chief Analyst Zhou Hua announced that in the first half of 2025, the sales volume of consumer grade AI/AR glasses in China reached 262000 units, a year-on-year increase of 73% and a historic high.

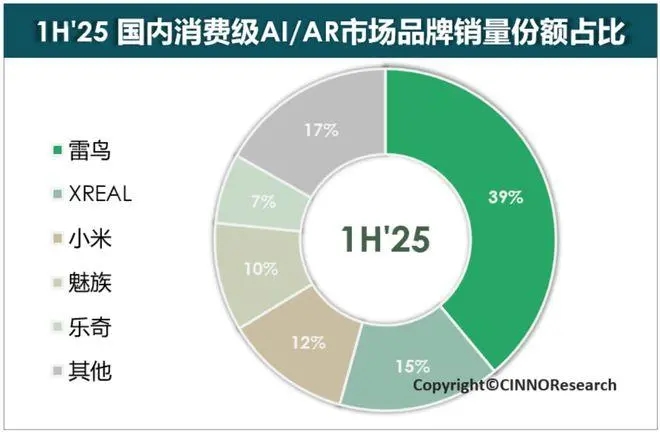

Driven by policy subsidies, 618 e-commerce promotion, and local brand innovation, screenless AI glasses have become a core growth point with a year-on-year growth rate of 463%. Leading brands such as Thunderbird and Xiaomi have pushed the industry into a new stage of large-scale popularization through technological iteration and ecological layout.

According to CINNO Research statistics, driven by both the national subsidy policy and the 618 e-commerce promotion, the market has ushered in a new round of product iteration boom, with breakthrough growth achieved in all three major sub categories. Among them:

Split type AR glasses: With the iteration of new products from top brands such as Thunderbird, prices continue to decline, achieving a steady year-on-year growth of 39% in sales. This category continues to consolidate its professional user base through lightweight design and ecological compatibility advantages.

AI glasses with screen (integrated AR): Sales increased by 14% year-on-year driven by brands such as Thunderbird and Yingmu. The addition of vertical application products such as Dear Di Translator has expanded the business office and cross language interaction scenarios.

Screen free AI glasses: Leading the market with explosive growth of 463% year-on-year in sales. New products such as Thunderbird V3, Xiaomi AI smart glasses, and Li Weike Meta Lens have successfully activated the mass consumer market through deep integration of AI voice interaction, sports and health monitoring functions.

Despite ongoing challenges, policy support and market potential still support optimistic expectations. CINNO Research predicts that the shipment volume of AI/AR glasses in China will reach 900000 units by 2025, a year-on-year increase of 133%, and the industry is expected to exceed 100 billion yuan within three years. Behind this growth, local brands are building content ecological barriers through three dimensions: cross device collaboration, cross domain applications, and cross industry cooperation. Technological breakthroughs and ecological improvement have become key variables determining victory or defeat.